专注为跨境企业提供一站式合规服务

10many+

Service Clients

50many+

Customer Inquiries

12many+

Inbound Tax ID

50many+

Number of declarations

Principal Business Operations

- VAT servicesAPI dockingOne-click DeclarationTax Number ManagementLetter ManagementVAT/EORI Query

- EPR servicesCompliance CheckOnline PaymentEPR InquiryEPR Management

- Product complianceLetter ManagementOne-Click RenewalCompliance Document ApplicationRelated Regulation Interpretation

- 海外工商海外公司注册海外公司年审海外公司信息变更海外公司本土认证海外公司注销

- Trademark and patentTrademark SearchTransparent FeesArtificial Name CheckSenior Lawyer Team

Core Advantages

Faster Aging

The tax number is faster and more stable

Quality Assurance

European local accounting firm

Focus on Service

100 person tax team, efficient service

After Sales Guarantee

Manual + AI customer service, answer at any time in 24 hours

Select Service

1 minute to complete the order, the fastest one day tax number

Intelligent Operation

System intelligent operation to reduce manual errors

One Click Declaration

Upload data independently and get results with one click

Registered Account

Registration is simple and fast, and it's easy to get done in 15 seconds

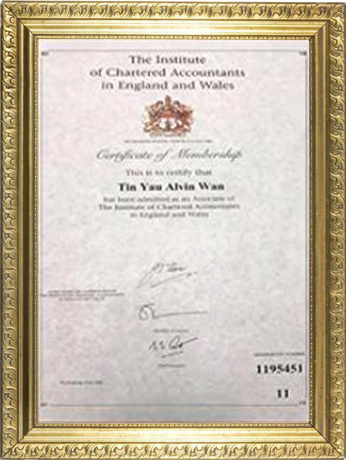

Company Qualification Certificate

关于跨信通

300人+ 团队规模

2017年成立

12万+客户

跨信通成立于2017年,是全球一站式出海合规服务平台,总部位于中国深圳,在广州、杭州、厦门、福州、郑州、长沙等10+核心城市设立分支机构,服务触达全国,同时在德国、法国、英国、意大利等海外多个国家设有本土化专业服务团队。目前已荣获亚马逊、速卖通、TEMU、SHEIN、美客多等电商平台生态认证,并入驻官方合规服务商城。

跨信通专注于为跨境卖家提供安全、高效的合规服务,涵盖全球VAT、欧洲EPR、商标专利、产品检测认证及海外工商注册等,打造品牌出海一站式合规服务体系,为出海企业提供全方面的合规选择。

查看更多